Solutions for Vietnam’s transitional wind and solar projects

27/04/2023So far, only about one-third of wind and solar project investors have submitted project documents in accordance with the guidance documents of the Ministry of Industry and Trade, preparing for the negotiation of electricity sales contracts and electricity prices. Although this is a very enthusiastic issue for investors, the slower the project is put into commercial operation, the more difficult the financial situation for investors. Why does this deviation phenomenon occur? What caused investors to delay providing project introductions to EVN? Expert analysis of Vietnam Energy Journal.

Wind and solar energy development (2019-2021):

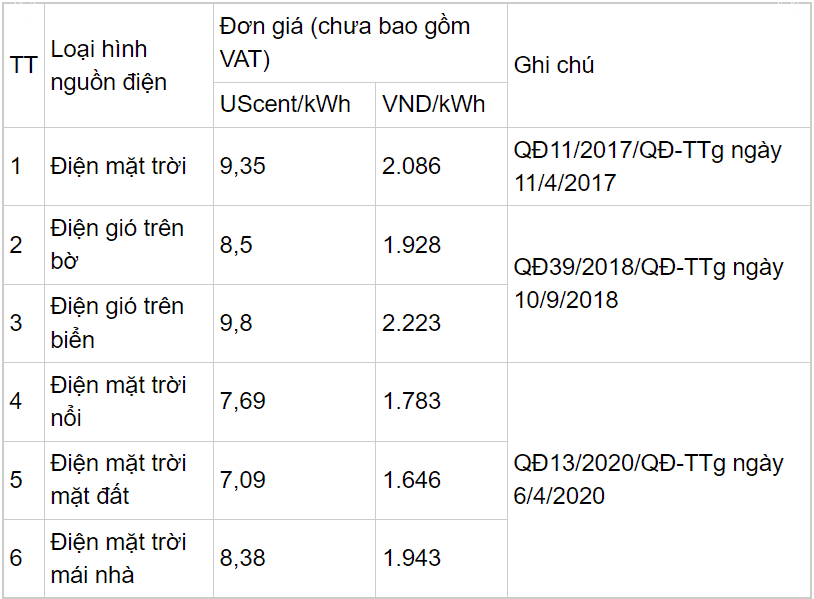

During the period from 2017 to 2020, Vietnam’s solar power generation experienced strong development through incentive mechanisms (Decision No. 11/2017/QD TTg of April 11, 2017 and Prime Minister’s Decision No. 13/2020/QD TTg of April 6, 2020).

As of the end of 2020, the total installed capacity of solar energy in China was approximately 19400 megawatts (16500 megawatts), accounting for approximately 25% of the total installed capacity of the national power system.

In order to achieve this figure, in addition to the basic reason for completing the construction of solar power plants within 6-9 months, FiT prices are the driving force for the rapid growth of this type of electricity.

Feed in Tariffs are a policy tool aimed at promoting investment in renewable energy. In particular, tariffs are the prices at which electricity generated from secondary energy is sold to the feed or grid. The term of the electricity purchase contract for solar power generation projects is 20 years (from the date of commercial operation), and the electricity price is adjusted based on the fluctuation of the Vietnamese dong/US dollar exchange rate.

On September 10, 2018, the Prime Minister issued Decision No. 39/2018/QD TTg, revising and supplementing some provisions of Decision No. 37/2011/QD TTg of June 29, 2011 on supporting the development mechanism of wind power projects in Vietnam. The rate under the Renewable Energy (NLT) incentive mechanism – FiT is entitled to 20 years, adjusted based on the fluctuation of the Vietnamese dong exchange rate against the US dollar, as shown in Table 1.

Since the introduction of incentive policies (natural resources 2086 Vietnamese dong/kWh, wind power 1900 Vietnamese dong/kWh) between 2017 and 2021, wind power and natural resources have flourished. According to the revised Electricity Plan VII, the total solar power generation capacity before 2020 is expected to be only 8500 megawatts. However, as of December 2020 (at the end of the solar power discount price), the total capacity of grid connected solar and rooftop solar power generation has reached 16500 megawatts. This is almost 20 times that of Power Plan VII.

After the Prime Minister’s Decision No. 39/2018/QD TTg on September 10, 2018, this field also began to attract the interest of many investors. According to the 2018 rate, the rate for wind power generation is 8.5 cents per kilowatt hour, equivalent to 1928 Vietnamese dong per kilowatt hour. This applies to some or all grid connected wind turbines with a commercial operation date of 20 years (from the commercial operation date) before November 1, 2021. Therefore, as of the end of 2021, the installed capacity of wind power generation has reached 4126 MW (according to Power Plan VII (revised), it is expected that by the end of 2020, the wind power generation capacity will reach 800 MW, and the new renewable energy capacity in 2021 will be 790 MW.

If there is a “hot” issue:

Firstly, faults during the operation of the electrical system:

The “hot” development has brought many challenges, first and foremost being the overload of the national transmission system. Due to the fact that the natural characteristics of solar panels depend on the duration of sunlight during the day (strong sunlight generates a large amount of electricity, while closed sunlight does not), the operation of the power system has encountered many difficulties and shortcomings.

In addition, the huge difference between high and low loads during the day also brings many difficulties to regulating the power system. The total capacity is 16500 megawatts, which is equivalent to about 40% of the national load at the noon low point.

The National Power System Regulation Center (A0) stated that due to low load, there is overcapacity during the lunch break from 10am to 2pm (especially on weekends and public holidays), but solar radiation is the best of the day. At the same time, during peak hours at night (approximately 17:30-18:30), the demand for electricity is the highest of the day, with tens of thousands of megawatts of solar energy almost unable to meet it.

Therefore, in order to ensure power supply, the power system always needs to maintain the availability of some traditional generator sets. In addition to the differences in load capacity at different times of the day, there are also significant differences in load demand between workdays and rest days. In particular, the difference in peak capacity between holidays and weekdays is approximately 5000 MW. Therefore, on weekends, A0 must ensure a sufficient number of minimum grid connected units based on the technical conditions of the system (ensuring availability, voltage mode, transmission restrictions, etc.), and stop the backup of multiple coal-fired power generation units and gas turbines.

In order to ensure the safety of the electrical system operation, A0 cannot adjust the full available capacity of the power supply. Especially during low load times (noon, weekends or holidays, Spring Festival), there are also renewable energy sources such as wind and solar energy.

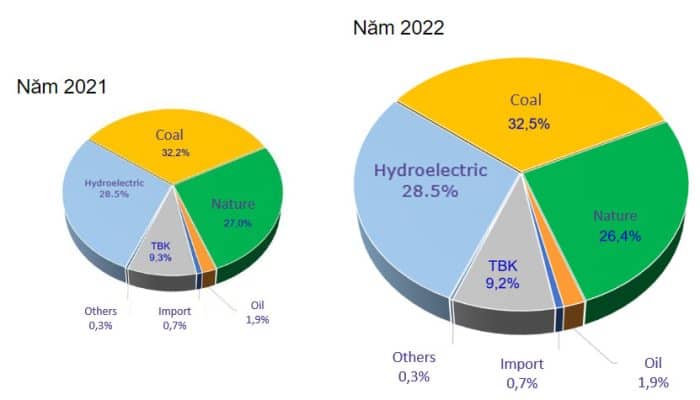

At present, through the AGC (Automatic Generation Control) system, the scheduling and mobilization of power plants on the system has been and is ongoing. This is an automatic regulation device system that can increase or decrease power generation capacity to maintain stable operation of the entire system. The overall system power structure for 2021 and 2022 is shown in Figure 1.

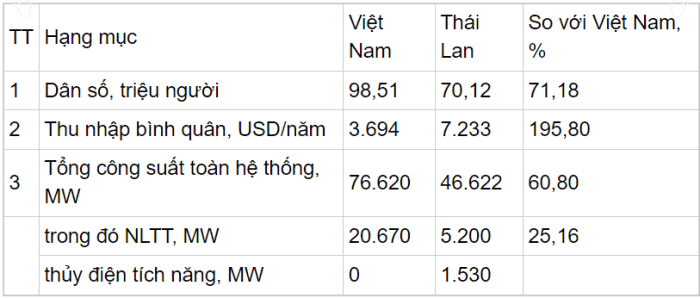

When comparing the power structure of Thailand’s power system and our country’s power system, the difference is clear. The total capacity of the Thai electricity system by the end of 2021 is 46,622 MW (capacity from RE is 5,200 MW, accounting for about 11% of the total capacity of the whole system), the population of Thailand is about 70 million people, and Vietnam is about 70 million people. 99 million people). If compared with the same level in 2021, the total capacity of the power system will reach 76,620 MW (capacity from renewable energy sources is 20,670 MW, accounting for 27%) compared to the total capacity of the whole system.

Thus, the proportion of RE capacity in Vietnam’s power system is more than 2 times higher than that of Thailand, but Thailand has built and operated 3 pumped-storage hydroelectric power plants (TNTs) with a total capacity of 1,530 MW. Which, Srinakarin (capacity of 360 MW), Bhumibol (capacity of 170 MW), and Lam Ta Khong (capacity of 1000 MW) are for storing electricity, covering the top and bottom of the load chart. Meanwhile, we do not have a power storage system yet. Currently, we are just building the Bac Ai Pumped Storage Hydropower project (capacity of 1,200 MW) with the expected put into operation in 2028. Population and total correlation. the installed capacity of the electricity system of Vietnam and Thailand (by 2021), see Table 2.

as of the end of 2021.

Second: Waste of social resources and renewable energy:

Compared to QD 39/2018/QD TTg on September 10, 2018 and QD 13/2020/QD TTg on April 6, 2020, we currently have 84 renewable energy projects with a total capacity of 4676.62 MW (including 4184.8 MW wind power and 491.82 MWac solar power), and the commercial operation progress is relatively slow.

After the competition to develop solar and wind power, many investors “missed a step” and were unable to operate in a timely manner to enjoy preferential prices. They sit on the fire every day. The failure to sign contracts to sell electricity to EVN, wind farms, and solar power plants has exposed equipment worth trillions of Vietnamese dong to sunlight and rain, causing operators to “sit and play, eat water,” and investors still need to pay wages. Material losses are incalculable. EVN cannot purchase electricity from this renewable energy source because there is no pricing mechanism, which wastes the country’s renewable resources.

What is the solution for transitional renewable energy projects?

According to international and domestic practices, FiT is a supportive pricing mechanism aimed at promoting investment in natural resources and wind power projects, and being regulated for a certain period of time. After the failure of the fixed price mechanism, it is necessary to establish a electricity price mechanism for solar power plants and transitional wind power plants. Choosing investors to develop renewable energy projects through bidding is considered a mechanism that brings many benefits and is an inevitable trend in the market, helping to improve transparency, competition, and economic efficiency.

In 2022, the Ministry of Industry and Trade submitted a document to the Prime Minister regarding the formulation of the Prime Minister’s decision, which stipulated a bidding mechanism for purchasing electricity from wind power projects. The bidding object is a project or part that has already been or is currently being invested in, but has not been put into operation on time in accordance with the provisions of Decision 39/2018/QD TTg and Decision 13/2020/QD TTg. However, the bidding for electricity prices for investors choosing renewable energy projects failed because there was no basis for implementation. Due to the provisions of the Investment Law, Price Law, and Electricity Law, bidding cannot be based on the competitive electricity sales price (final price) as the bid winning price standard.

In order to develop a pricing framework for transitional renewable energy projects, on October 3, 2022, the Ministry of Industry and Trade issued Notice No. 15/2022/TT-BCT, which stipulated the method for determining the pricing framework for transitional wind power plants. According to the provisions of this notice, EVN has prepared and submitted the calculation results of the price framework for solar power generation and transitional wind power to the Ministry of Industry and Trade.

According to the results submitted by EVN, the Ministry of Industry and Trade issued Decision No. 21/Q Đ – BCT on January 7, 2023, which sets out the price framework for solar power generation and transitional wind power, serving as the basis for EVN and early investors to reach electricity price agreements to put factories into operation and avoid wasting resources.

Therefore, the price framework is calculated based on the costs specified in the feasibility study report, which evaluates 99 solar power plants (including 95 surface solar power plants and 4 floating solar power plants) and 109 wind power plants that have signed power purchase contracts with EVN. EVN proposes four pricing schemes (including calculations based on investment interest rates, loan interest rates, interest rates, and taxes, or excluding calculations based on investment interest rates and power generation factors). However, the price framework provided by EVN did not satisfy investors and stated that if implemented, it may lead to losses and bankruptcy for the company

Price negotiations are reasonable and aim for profitability for enterprises (including investors in renewable energy and EVN projects), but they must be coordinated with the interests of the country and consumers. Electricity price negotiations should be conducted in the spirit of coordinating the interests of all parties and sharing risks, under the guidance of the Prime Minister. At the same time, the project must fully comply with legal provisions related to land, construction, electricity, planning, environment, and fire protection.

Recently, investors from Nam Binh Wind Power Co., Ltd. – Nam Binh No.1 Wind Power Plant (Nam Binh, Đak Song, Đak Nong District) have sent letters to the Ministry of Industry and Trade, EVN, and Power Sales Company, allowing them to operate temporarily for commercial purposes, During the negotiation and negotiation of power generation prices, confirm the power generation capacity and pay 50% of the price to onshore wind power plants (issued in accordance with Decision No. 21 of the Ministry of Industry and Trade on January 19, 2023). Investors promise that during the electricity price negotiation period, they will not make any claims for the temporarily raised electricity, nor will they trace the value.

Obviously, the slower the transition solar and wind power projects are put into operation, the greater the harm they will cause to investors and the greater the waste of renewable resources endowed to us by nature.

On March 16, 2023, Deputy Prime Minister Tran Hong Ha requested the Ministry of Industry and Trade to review the current regulations and relevant laws on electricity activities, in order to review and guide the temporary power generation mobilization of transitional projects that have completed construction investment. Meet operational technical requirements during the negotiation/negotiation of power generation prices between the power buyer and seller in accordance with regulations. This is a solution to the difficulties faced by enterprises (including EVN and wind and solar investors).

Regarding the temporary mobilization of power generation from transitional power plants, it is recommended that the Ministry of Industry and Trade report to the Prime Minister and issue a temporary electricity price, allowing EVN to mobilize transitional power plants and pay electricity bills according to the temporary electricity price. When EVN signs formal electricity prices with investors, the electricity sales revenue of these projects will be adjusted.

However, there is a clear legal solution that requires authorization (from the Prime Minister, the Ministry of Industry and Trade) to decide whether a new generation price framework needs to be issued to replace the price framework determined in Decision No. 21/QD-BCT of January 7, 2023? Or let both parties negotiate electricity prices based on the decision of January 7, 2023 No. 21/QD-BCT? This issue belongs to the national regulatory agency, not EVN and enterprises with wind and solar energy projects!

Source: nangluongvietnam.vn

Must Read

You may be interested in

Priority is given to investing in 29 seaport projects with a total capital of over 31 trillion Vietnamese Dong sourced from the state budget

Ba Ria – Vung Tau to become national marine economic hub

Improving the capacity of shipbuilding enterprises, catching the wave of opportunities

Completing negotiations and signing power purchase agreements with 40/40 transitional renewable energy investors

Vietnam expected to emerge as a prominent logistics player in Asia

Freight transportation from Ho Chi Minh City port to Barion Head port

Ho Chi Minh City orients to develop Can Gio “superport”

The maritime industry strives for green transformation