The shipping industry dreams of another big year of profit

10/05/2022Shipping enterprises are expected to have an additional year of high profitability with a logistics fare scenario that is difficult to lower immediately and production is recovering.

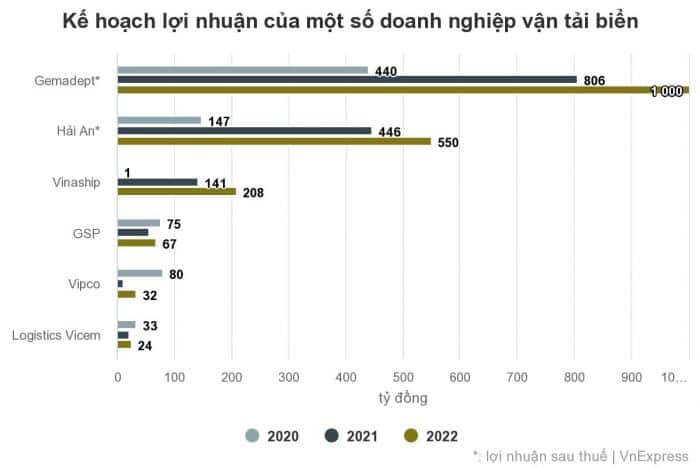

This year, Gemadept Joint Stock Company (GMD) set a revenue target of VND 3,800 billion, profit after tax hit a record 1,000 billion. Both targets increased by 19% and 24% year-on-year, respectively. This is also the most profitable plan in the shipping industry. Also expecting the same growth rate of GMD, Hai An Transportation and Loading Joint Stock Company (HAH) wants to profit 550 billion VND.

After a year of surging interest up to hundreds of times, Vinaship Shipping Joint Stock Company (VNA) also plans to increase profits by nearly 15% to VND 208 billion. If completed, this year continues to create a new record for Vinaship in terms of profits, wiping out the remaining accumulated losses of this business after a long period of trading.

Meanwhile, Vipco Petroleum Transportation Joint Stock Company (VIP) aims to increase profits by 3 times, but the actual number is only about 32 billion. This is a relatively low level compared to enterprises in the same industry and lower than the profit base of Vipco itself in the period before 2018. In the last 3 years, the business results of this enterprise have decreased largely due to the impact of the epidemic, rising fuel prices and plans to repair and rejuvenate the fleet.

After a year of upswing in profits, the port enterprises evaluated continued to enjoy a favorable business environment. Mirea Assets Vietnam (MASVN) said that the sector still has a lot of momentum from attracting FDI, improving production activities, recovering water transport and the economic situation in Vietnam’s main export markets has many prospects.

Last year, soaring shipping prices became one of the main factors driving the industry’s profitability to high. Vietcombank securities (VCBS) predict that transport fares will lower but it is difficult to return to the low level this year. The reason is that some large production and consumption centers, especially located in Asia with a large population size such as China, India… will need more time to achieve community immunity. China continues to pursue its “zero Covid” strategy through strict lockdown measures. In addition, the supply of new container ships will only begin a strong handover period from 2023.

While international freight rates have not been able to quickly cool down, SSI Securities anticipates further increases in domestic freight rates. Container shipping companies have the potential to increase their profit margins due to high charter prices and inland freight rates.

Taking advantage of the above, businesses are pushing to upgrade their fleet and expand their operating network. One of Hai An’s major tasks this year is to cooperate with foreign shipping companies to develop intra-Asian transport routes, first of all, Southeast Asia and Northeast Asia. At the same time, this enterprise also wants to buy 2 more used container ships of 1,600-1,700 TEU type and build new ships from 2-3 container ships of 1,800 TEU.

This year, Vipco Petroleum Transport Joint Stock Company will liquidate Petrolimex 10 ships and accelerate ship investment for vehicle renewal. This business aims to rejuvenate and maintain fleet capacity. In parallel, Vipco plans to coordinate with Petrolimex and related units to operate the fleet effectively.

However, the epidemic remains a constant industry risk for the time being. MASVN pointed out, so far Covid-19 continues to affect seaport activities in the world. With the “zero Covid” strategy, in the first months of this year, China continued to blockade major cities to limit the outbreak. Similarly, operations in large seaports in addition to recording high growth also occurred due to the stagnation due to preventive measures that extended the clearance period.

The agency believes that shipping operations around the world are at risk of being disturbed and ineffective if this situation continues. This adversely affects maritime routes to Vietnam as well as import and export activities.

The danger from the epidemic also led some shipping enterprises to put their profit plans backward this year. PVTrans predicts the lowest profit level from 2015 to date when after-tax profit could be reduced by up to 48%. Transport and Trading Services Joint Stock Company (TJC) plans a 13% decrease in profit before tax. One of the reasons for this business is the volatile situation in the Middle East, the Russian-Ukrainian conflict caused the price of oil to escalate, increasing fuel costs.

In addition, some enterprises forecast a decrease in profits due to plans to sell ships, which led to a slowdown in transport output. In particular, the Vietnam Maritime Corporation (Vinalines – MVN) proposes to reduce the profit before tax by more than 30% due to the above reasons in subsidiaries such as Vinaship, VIMC Shipping, South China Sea, Vitranschart… Meanwhile, the parent company’s earnings before tax is still expected to increase slightly by more than 4%.

In the stock market, shipping sector stocks have always grown well since the beginning of the year. Particularly during the period of geopolitical tensions in early March, many of these sector stocks recorded ceiling increases. Recently, low-liquidity codes began losing momentum, mainly due to the overall impact of the stock market.

However, stocks of large enterprises still tend to “go backwards”. Closing trading session on April 20, GMD code reached the market price of 55,600 VND a unit, up more than 15% compared to the beginning of the year. Since the end of the week, the code continues to exceed the 100,000 VND mark, closing the April 20 session to more than 46% compared to the beginning of the year.

Source: VNExpress

Must Read

You may be interested in

More than 236 million tons of cargo through seaports in 4 months

Ha Tinh has made many efforts to attract investment and develop the seaport system

The shipping industry dreams of another big year of profit

Import and export of Ho Chi Minh City impressive growth in Q1/2022

GDP in the first quarter increased by 5.03%

Risks of ‘doing business at the ocean’ by exporting enterprises

Proposing to invest more than VND 150 billion to build marine fairway into Tho Quang terminal